Can you purchase an apartment strengthening that have FHA funding? And you can what i’m https://paydayloanalabama.com/carlisle-rockledge/ saying is is it possible you pick a good duplex, triplex or fourplex having fun with FHA financing? You may possibly have read from real estate expenses podcasts otherwise books on having the ability to benefit from an enthusiastic FHA Loan because the an excellent first-time domestic buyer to suit your first apartment strengthening. Which is higher information, but may you probably eliminate it off?

The newest Government Casing Government (otherwise FHA in a nutshell) will bring mortgage insurance on finance from FHA-acknowledged loan providers all over the country, making it possible for a trader to buy a beneficial multifamily possessions that have a beneficial step 3.5% advance payment rather than an effective 20% deposit that have a conventional mortgage. Thus with respect to having the ability to spend a reduced down commission, it is an easier choice allowing you to use extra money. It’s good system, but may it work on apartment structures? Can it work with the metropolis out-of Enough time Coastline, California?

The latest short answer: If you purchase a beneficial multifamily property and live in certainly one of this new systems, you can make use of FHA money. It will work for duplexes, but it is a unique tale for triplexes and you will fourplexes.

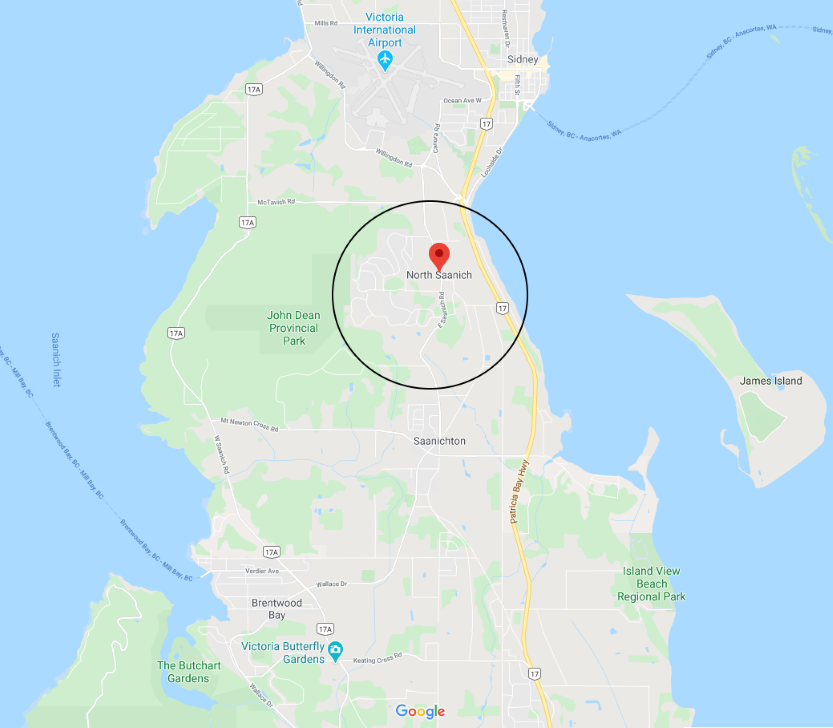

To respond to that it matter, i assessed latest fourplex transactions over the past few years (2016-2020) during the Enough time Beach, and also the wide variety had been shocking:

The new recent study informs us that it’s rare but in fact you’ll be able to discover an FHA financing buying a great multifamily duplex or fourplex possessions. Then exactly why is it thus unusual and difficult become accepted to possess a keen FHA loan if they are so popular and just about every other podcast or publication suggests they?

That is the reason why it’s so tough to get a good triplex or a fourplex, is because these types of properties first need certainly to admission new FHA Mind-Sufficiency Take to. In order to ensure the borrowed funds financing, the new FHA really wants to remember that this new multifamily property is notice-sufficient. It means, that overall book that you receive to the devices have to be equivalent or more than the borrowed funds percentage or any other expenses.

Thus regardless of the home loan company you are going due to, it should admission brand new FHA Thinking-Sufficiency Test. Ultimately, it’s all very determined by the fresh FHA-acknowledged appraiser’s choice off markets lease, and it’s really an emotional (and you will extremely difficult) standard to take and pass.

It is quite vital that you look for mortgage lenders exactly who have inked FHA loans to have single-family members properties and you may duplexes, but still envision one may become acknowledged to have an effective triplex otherwise fourplex.

The fresh FHA’s loan and you may financing system is superb, so we love it! However, if you’re looking to invest in an effective multifamily property which have 3 or cuatro products, because of them, it will be an enormous hurdle to track down around the. In other cities as much as South California, it may or may possibly not be convenient, but in Enough time Beach we understand to own a fact that this new probability of getting a loan is actually below 1%. It is a myth you to definitely anybody could well be recognized.